NY WH-38 2009-2024 free printable template

Get, Create, Make and Sign

Editing wh38 online

How to fill out wh38 form

How to fill out wh 38?

Who needs wh 38?

Video instructions and help with filling out and completing wh38

Instructions and Help about wh38 form

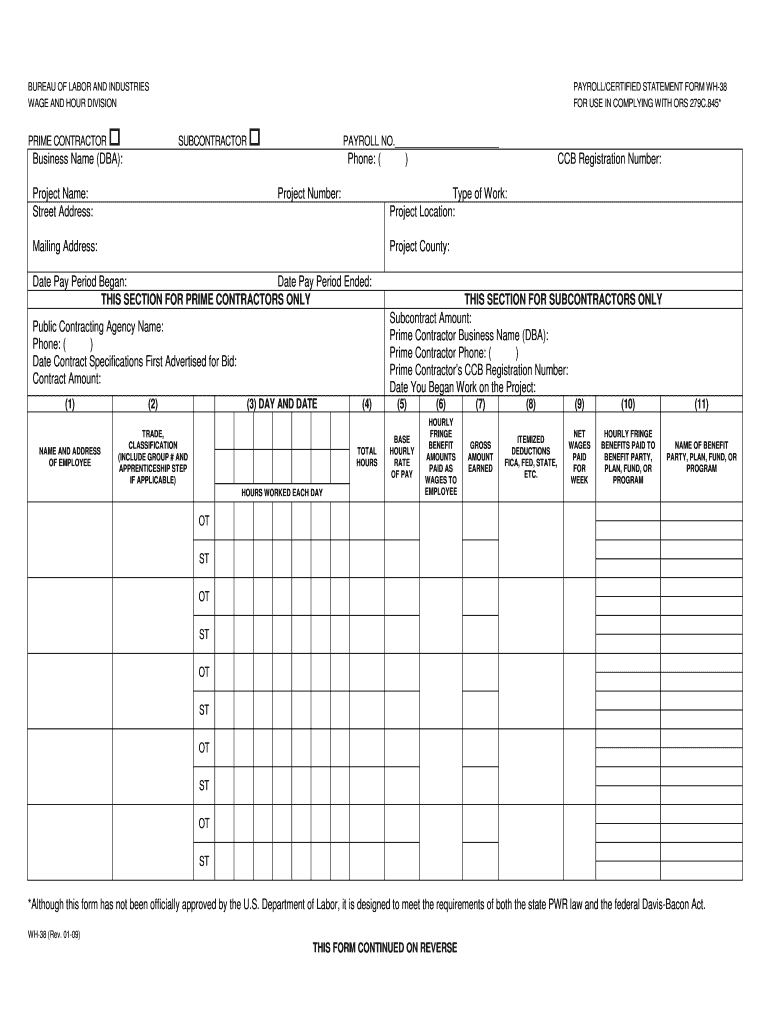

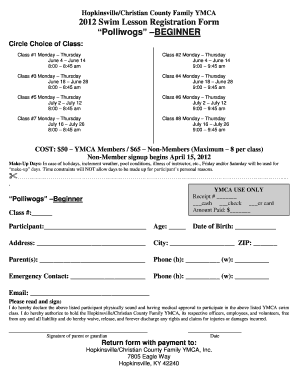

Oregon's law requires employers to pay at least the applicable prevailing wage rate for an employee's work on a public works project covered by the state's prevailing wage rate laws additionally these contractors and subcontractors must file certified payroll reports and statements for each week of work on the project by doing so employers certify under oath that all workers were paid at least the applicable prevailing wage rate commonly refer to as PWR in full and for all hours worked this video will provide general instructions for employers on how to comply with testate's certified payroll requirements by demonstrating how to complete the WH38 Boris prevailing wage rate payroll and certified statement form if at the end of the video you still have questions or need assistance completing certified payroll please contact bully's PWR unit for help before I get start edit's worth mentioning that keeping accurate and complete payroll record sit's not only required by law but doing so can help make completing certified payroll easier since certified payroll primarily reports hours worked and wages paid the process of completing certified payroll generally involves transferring information from your original payroll records to a payroll report form owlet's begin by selecting the correct form to useful makes the WH-38 form available to the public to help employers comply with their certified payroll requirements under the law this form is available for download in multiple formats on bully's website and contains two pages the firsts the payroll report page it asks for the hours worked pay rates payment information and general project information the second page is the certified statement which confirms that the information provided is true to your knowledge please note BOLD does not require employers to use page 1 of this form to report payroll however if you choose to use a different form it must supply all the information requested on page 1 of the WH-38 form regardless of what form you used to report payroll all employers must certify the reports by signing and dating page 2 of the WH-38 and submitting it with their payroll report please also be aware that completing and submitting the US Department of Labor's payroll report federal form WH-347 on project subject to Oregon's PWR law does not satisfy bullies filing requirements let's now look at each section of the WH-38 form there are two general sections on the payroll report page the top is for general information about your company and the project and the bottom is for reporting your employees hours and wages starting with the top you must report your business'name phone number addresses the type of work you are performing and inapplicable your CCB registration number and as for the project you must report its name location and if applicable identification number generally this information will remain the same from week to week answer all the questions ensuring that no box is left unanswered...

Fill form : Try Risk Free

People Also Ask about wh38

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your wh38 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.